Can You Have Multiple Venmo Accounts? Safe Setup & Management Guide

Take a Quick Look

Learn the rules for managing multiple Venmo accounts safely. Avoid getting your account frozen. Want to manage profiles securely? Try AdsPower for risk-free multi-account management.

Picture this: you’re a freelancer who just started a small side business. You’ve been using your personal Venmo for years to split dinners and share rent, but now you need a way to get paid professionally. Or maybe you’re managing finances for a club or a family member. A question pops into your head: Can you have multiple Venmo accounts?

It’s a common dilemma. We naturally want to separate our personal and professional lives, even in our digital transactions. But before you rush off to create a second profile, you need to know the rules. Venmo’s policies are strict, and getting it wrong could lead to frozen funds or a permanent ban.

In this guide, we’ll cut through the confusion. We’ll answer the burning questions like “can you have two Venmo accounts?” and “can you have multiple Venmo accounts on one phone?” More importantly, we’ll show you how to manage multiple profiles safely and efficiently, without risking your account. Let’s dive in.

Do you know Venmo’s Account Policy?

First things first, you must understand that Venmo, like most financial platforms, has a strong stance on user identity. Their primary goal is to prevent fraud, money laundering, and other illicit activities. This is why their User Agreement is so clear about account ownership.

At its core, Venmo’s policy is designed for one person, one identity. They state that you are not allowed to create more than one personal account. This is non-negotiable. Your account is tied to your legal identity—your name, your Social Security Number (for verification), and your phone number.

Trying to create a second account that mimics a separate personal identity is a direct violation. It’s crucial to start from a place of knowledge. Always refer to the official Venmo User Agreement for the most current rules. Trust us, it’s a boring read, but it will save you a major headache later.

Can You Have Multiple Venmo Accounts? (The Real Rules & Limitations)

So, let’s get to the heart of the matter. Can you have multiple accounts on Venmo? The answer is: it depends on the type of accounts.

Scenario 1: Two Personal Venmo Accounts – Generally NOT Allowed

This is the big one. Venmo explicitly prohibits having two personal accounts. If you try to create a second account using a different email or phone number but the same legal name and identity, you are breaking the rules. The system is designed to catch this, and it can lead to both accounts being suspended. Don’t do it.

Scenario 2: Personal + Business (Venmo for Business) – SUPPORTED

This is the officially sanctioned way to have two Venmo accounts. Venmo encourages users to create a separate business profile linked to their personal account. It’s a feature, not a workaround.

- How it works: Your business profile has its own username (@YourBusinessName) and transaction history, keeping your professional payments separate from your personal pizza splits.

- The key: Both profiles are under your single Venmo account, verified by your identity. You switch between them within the same app. This is Venmo’s preferred and safe method.

Scenario 3: Two Different Venmo Accounts for Separate Bank Accounts – Risky

Some users wonder if they can have two different Venmo accounts tied to two different bank accounts, perhaps for budgeting. This is extremely risky. Even if you use different emails and phone numbers, you would likely need to use different legal identities (which is against the rules) to pass verification. This almost certainly will trigger an account review and likely result in a ban.

How to Safely Manage More Than One Venmo Account

For those who need to manage separate entities—like a business owner handling multiple brands or a marketer managing client accounts—safety is paramount. Here’s your actionable guide.

- Understand Venmo’s Policies (Yes, Really)

We’re saying it again because it’s that important. If you’re managing a business profile for your company or a profile for a legitimate entity (like a registered LLC), ensure you’re using the Venmo for Business feature correctly. Never misrepresent an account’s purpose. - Separate Identity & Banking Completely

Each Venmo account must be a truly separate entity. This means:

-

Unique Email Address: Each account needs its own dedicated email.

-

Unique Phone Number: A separate mobile number for verification and security is mandatory.

-

Unique Bank Account/Card: Funding sources cannot be shared across accounts. This is a major red flag for Venmo’s fraud detection.

-

- Use Distinct Devices or Virtual Environments

A critical question we see is, “Can you have the same Venmo account on two phones?” Yes, you can log into your same account on multiple devices. But for managing different accounts, this is a bad practice. Logging multiple accounts in and out on the same device and browser can link them together in Venmo’s eyes, potentially triggering a security review.

The safest method is to use a completely separate device for each account. But who has a stack of phones lying around? - Leverage Multi-Account Management Tools

This is where modern solutions save the day. Anti-detect browsers, e.g.:AdsPower, are designed specifically for this purpose. They allow you to create isolated virtual browser profiles on a single computer.

Each environment has its own unique digital fingerprint—like a separate device—making it safe to log into different accounts without them being linked. This is a game-changer for:

- Social media managers.

- E-commerce sellers with multiple stores.

- Affiliate marketers.

- Anyone who needs to manage separate financial profiles securely.

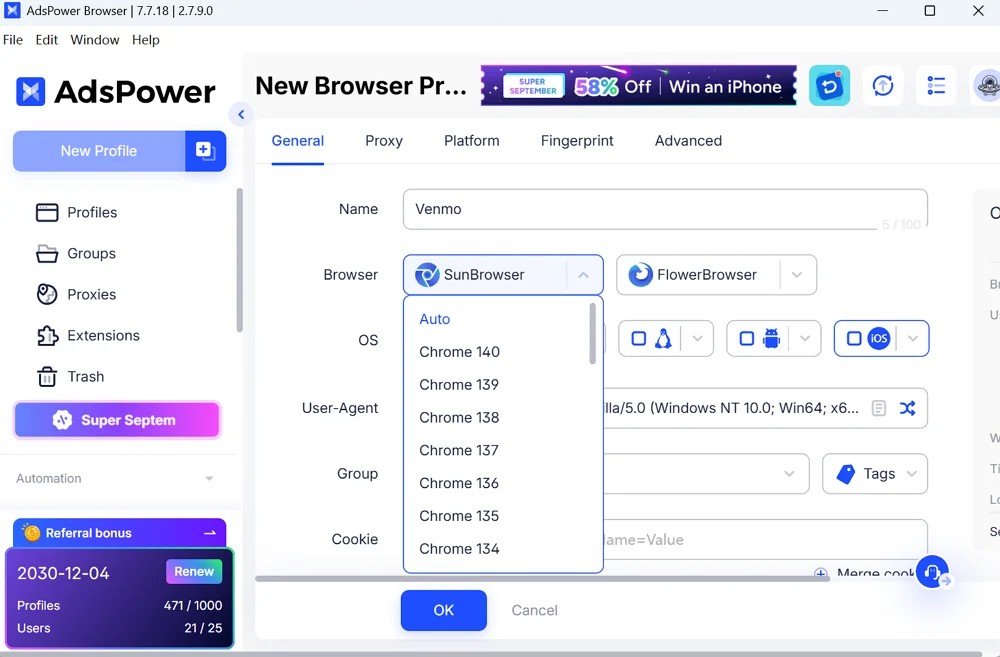

Learn how to set up Venmo profile in AdsPower:

- Create a new profile via "New Profile".

- Enter name, browser, OS, UA, remark etc.

- Integrate the related proxy info for the profile.

- Input the venmo.com into the platform and tab area.

- Customize the fingerprint based on your scenarios.

- Save your settings.

By using an account management tool like AdsPower, you eliminate the risk of cross-contamination between your accounts, keeping each one safe and compliant within its own isolated space.

Note: The Venmo web version is mainly a supplementary tool for querying and management, but it cannot be used to send payments and scan code.

Issues You Might Face (And How to Solve Them)

Attempting to operate outside of Venmo’s guidelines often leads to trouble. Here are common problems and their solutions.

Problem: “Why is my Venmo account frozen?”

This is the most common consequence of violating policies. Venmo can freeze your account if they suspect:

- You are operating multiple personal accounts.

- There’s suspicious login activity (e.g., rapid switching between accounts on one IP).

- Your identity cannot be verified.

Solution:

- Contact Venmo Support Directly. Be honest and transparent. If you were using a business profile incorrectly, explain the situation.

- Provide Verification Documents. They will likely ask for a government-issued ID, SSN, or proof of address. Have these ready.

- Be Patient. Resolution can take from a few days to several weeks. The key is to cooperate fully.

Problem: Can’t Verify Your Identity for a Second Account

If you’re trying to create a legitimate business account for a registered company and hit a verification wall, it’s often because the system is conflating it with your personal identity.

Solution:

Use the Venmo for Business setup flow, which is designed to handle this. If problems persist, contact support before attempting to create a separate standalone account.

Problem: Getting Logged Out Unexpectedly

If you’re frequently switching accounts on the same app, Venmo’s security may log you out, interpreting the activity as a potential hack.

Solution:

This is a clear sign that your management method is risky. Stop switching accounts on the same device and move to a more secure solution like using separate browser profiles or a dedicated anti-detect browser.

Frequently Asked Questions (FAQs)

- Can I have two personal Venmo accounts?

Generally No. Venmo’s User Agreement strictly prohibits one person from having more than one personal account. Attempting to do so will likely result in both accounts being frozen or permanently banned. - Can I use one Venmo account across two devices?

Yes, absolutely. You can log into your single Venmo account on multiple phones or tablets. This is perfectly safe and allowed. The security risk involves logging different accounts into the same device frequently. - Can I have multiple Venmo accounts on one phone?

Technically, you can log in and out of different accounts on one phone, but it is not recommended. This activity can appear suspicious to Venmo. The safest way to manage multiple Venmo accounts on one phone is to use the built-in business profile feature for a personal+business setup. For truly separate accounts, using a secure management tool on a computer is far better. - Can family members use Venmo on the same Wi-Fi or network?

Yes. It’s common for family members in the same household to have their own individual Venmo accounts and use the same Wi-Fi. Venmo’s systems are designed to handle this. The issue isn’t the network; it’s one person operating multiple accounts from the same device.

Conclusion

Navigating Venmo’s rules doesn’t have to be confusing. Remember: one personal account per person, and use the built-in business profile for your professional needs. For power users who need to manage multiple, legitimate entities, your best bet is to use tools that prioritize security and isolation, like AdsPower.

Understanding and respecting the platform’s policies is the only way to ensure your money and accounts remain safe.

Ready to manage your online profiles with confidence and security? Explore how AdsPower can help you streamline your workflow without compromising safety.

People Also Read

- How to Register a Gmail Account Without a Phone Number 2026

How to Register a Gmail Account Without a Phone Number 2026

Learn how to register a Gmail account without a phone number in 2026. Follow our expert guide to bypass verification using clean IPs and AdsPower

- Badoo Ban – Why & How to Get My Badoo Account Unblocked

Badoo Ban – Why & How to Get My Badoo Account Unblocked

A complete guide to Badoo bans explaining why accounts get blocked, how to appeal and restore access, detect IP bans, and lower the risk of being bann

- How to Create a LinkedIn Account for Business (2026 Guide)

How to Create a LinkedIn Account for Business (2026 Guide)

Learn how to create a LinkedIn account for business in 2026, with clear setup steps, account structure explained, and practical ways.

- Microsoft Login Guide: live.com vs microsoftonline.com vs microsoft.com

Microsoft Login Guide: live.com vs microsoftonline.com vs microsoft.com

Confused about Microsoft login portals? This expert guide explains live.com, microsoftonline.com, and microsoft.com so you can choose the right one

- Match.com Account Management: Delete, Unblock & Protect with Fingerprint Isolation

Match.com Account Management: Delete, Unblock & Protect with Fingerprint Isolation

Learn how Match.com manages accounts, how to delete or recover a blocked profile, and how fingerprint isolation helps protect and separate dating acc