CEX vs DEX Guide: Use Multiple Accounts to Join Binance Launchpads Safely

Take a Quick Look

Wondering CEX vs DEX and how to use them? Don’t worry, we will tell the difference between them and list tips to use multiple accounts to join Binance launchpads with AdsPower browser.

If you’re serious about token launches, you’ve probably noticed a pattern: centralized exchanges (CEXs) like Binance offer curated launch programs with big liquidity, while decentralized exchanges (DEXs) give open, permissionless access from your own wallet. Many power users manage more than one account or wallet to separate strategies, share work within a team, and reduce operational risk. This guide explains how to do that safely and clearly—especially for Binance Launchpads—while using AdsPower to organize browser profiles. Nothing here is legal advice. Always follow the latest Terms of Use in your region and complete any required KYC/AML checks before you participate.

People Also Read:

For Beginners: How to Get Crypto Airdrops in 2025

What Is a CEX in Crypto?

A CEX is a company-run trading venue. You deposit funds, the exchange safekeeps them (custodial model), and orders are matched in an order book. You get familiar features: fiat on-ramps, mobile apps, margin, customer support, and polished UX.

Pros

● Easy onboarding and high liquidity

● Curated listings and structured launch programs

● Support and clear policies

Cons

● You must pass KYC/AML and accept regional restrictions

● Funds are custodial—you rely on the exchange’s security and solvency

● Features can change with policy updates

For launchpads, the structure is a big advantage: there are clear timelines, snapshot windows, and allocation rules. The trade-off is eligibility: access may depend on verification status, your location, and other program conditions.

What Is a DEX in Crypto?

A DEX lets you trade directly from your self-custody wallet using smart contracts. You keep your keys, approve swaps, and interact with liquidity pools 24/7—no centralized custodian in the middle.

Pros

● Permissionless access and global reach

● Self-custody and composability with other on-chain tools

● Continuous markets

Cons

● You’re responsible for wallet security and approvals

● Risk of malicious contracts, phishing, and MEV

● Fewer guardrails and limited user support

DEX participation is often “first-come, first-served” at listing time, and price discovery can be chaotic. There’s no guaranteed allocation unless the project designs one on-chain.

CEX vs DEX: Key Differences for Launchpad Participation

Access and eligibility

● CEX: Structured rules, KYC/AML, regional restrictions, and documented timelines.

● DEX: Anyone with a compatible wallet and gas can interact, but there’s no built-in vetting.

Custody and control

● CEX: Custodial—convenient, but you trust the exchange.

● DEX: Non-custodial—full control plus full responsibility.

Allocation mechanics

● CEX: Typically rule-based (balance snapshots, subscriptions, or staking), which reduces gas wars and formalizes distribution.

● DEX: Open trading on listing; competition in the mempool and slippage are common.

Compliance and recourse

● CEX: Clear ToS and support channels; obligations are explicit.

● DEX: Fewer barriers, but you must still follow your local laws, and recourse is limited.

Why Traders Use Multiple Accounts for Launchpads

Segmentation of strategies

● Keep long-term holdings apart from launch funds.

● Separate hedging, farming, and trading to avoid mix-ups and to simplify reporting.

Risk management

● Reduce single points of failure: if one login device breaks or 2FA fails, another account or sub-account can continue the workflow.

● For teams, separate roles (treasury, execution, reconciliation) across accounts for cleaner permissions.

Governance and compliance

● Many exchanges allow sub-accounts under one verified main account or provide corporate accounts for institutions. This gives role-based access and clearer audit trails.

● Avoid creating unrelated personal accounts to work around rules. When in doubt, read the exchange’s current ToS and ask support about compliant structures.

Note: Most platforms allow only one personal account per individual. If you need multiple seats, look into entity accounts and sub-accounts that are explicitly permitted and verified.

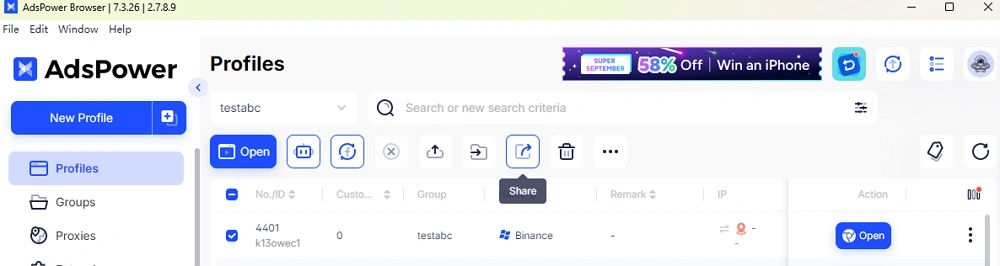

How AdsPower Helps Manage Multiple CEX/DEX Accounts Safely

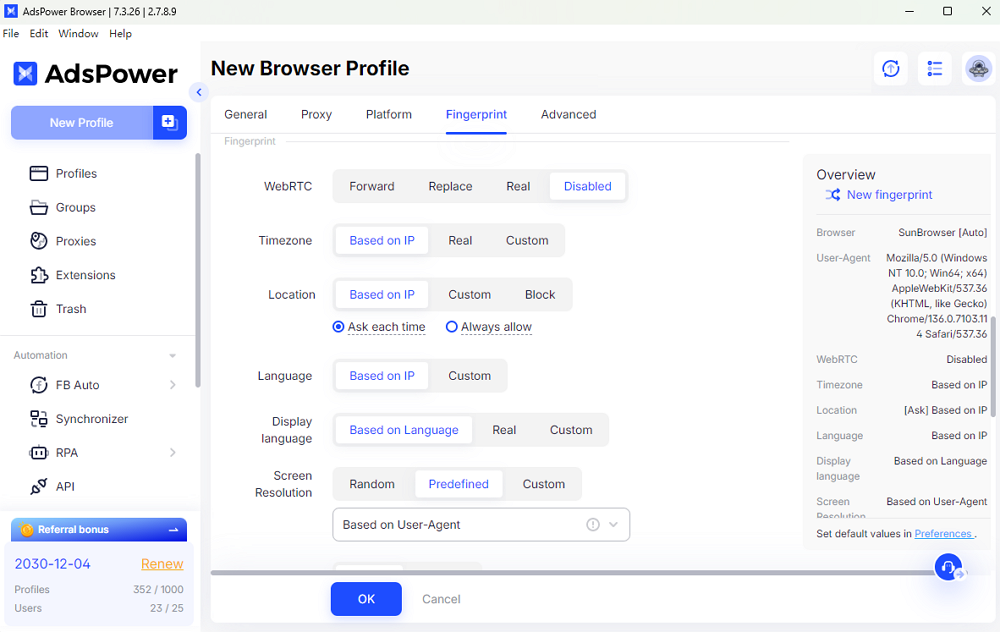

Running more than one account or wallet from the same machine can leak signals that make sessions look related: browser fingerprints (canvas, WebGL), cookies, timezones, fonts, user agents, and IPs. AdsPower lets you create isolated browser profiles so each account or wallet operates in its own “container.”

What to use AdsPower for

● Profile isolation: Cookies and local storage don’t mix across profiles.

● Fingerprint separation: Each profile can present a consistent, distinct environment.

● Proxy binding: Assign a dedicated proxy per profile to keep IPs stable and appropriate for your verified region.

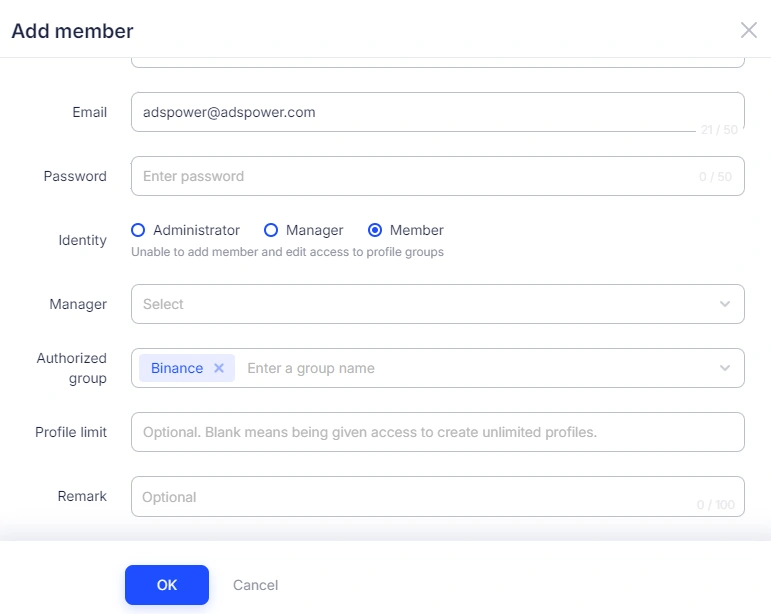

● Team collaboration: Share specific profiles with teammates without exposing seed phrases or master credentials.

If you want to share profiles with friends who are not on the same team account, you can also use AdsPower's profile sharing feature.

Important: Use AdsPower to improve security, organization, and compliance—not to evade exchange rules. Keep your setup consistent with the ToS you agreed to.

Step-by-Step: Safe Multi-Account Setup for Binance Launchpads

Compliance first: assume one personal Binance account per individual. If you need separation for desks or teams, pursue institutional onboarding and use exchange-approved sub-accounts. Always confirm policies for your country.

1. Choose structure: individual vs. company. Don’t create multiple personal accounts.

2. KYC correctly: complete personal or corporate verification; never share personal credentials.

3. Sub-accounts: created by function (treasury, trading, Launchpad). Set per-sub-account deposit/withdrawal rights and API scopes. Restrict who can commit funds.

4. Roles & security: least-privilege access, hardware-key 2FA, password-sharing ban, and withdrawal whitelists.

5. Segregate operations (AdsPower): one browser profile per sub-account, clear labels, bound authenticators/YubiKeys, and approved office/static IPs.

6. Capital & snapshots: pre-fund ahead of snapshot windows; avoid last-minute transfers; document all internal moves.

7. Pre-event checks: confirm eligibility and caps; verify snapshot and subscription times; rehearse on a no-funds test flow.

8. Execute & log: submit from the designated sub-account only; record TX IDs, timestamps, and amounts; avoid parallel clicks.

9. Reconcile & vesting: match allocations to your ledger; calendar cliffs/tranches; set velocity limits and withdrawal whitelists.

10. Post-event review: export logs from AdsPower and the exchange; update runbooks; refine roles and controls.

This workflow delivers the benefits of “multiple accounts” through compliant sub-accounts + role separation—without violating one-person-one-account rules.

Best Practices for Participating in Launchpads via CEX & DEX

Operate inside the rules

● Respect one-person-one-personal-account policies. If you need multiple seats, use explicitly permitted structures such as corporate accounts and sub-accounts.

● Re-check rules regularly—eligibility, limits, and regional access can change.

Design for traceability

● Keep a short journal per account: deposits, snapshot balances, subscription amounts, allocations, and hedges.

● Use consistent profile names and tags in AdsPower to make reviews easy.

Segment keys and permissions

● On CEX, separate funding, trading, and withdrawal permissions.

● On DEX, use different wallets for strategy vs. treasury; isolate signers and keep hardware backups.

Avoid accidental linkage

● Don’t log into multiple accounts from the same raw browser, device, or IP.

● Keep profiles consistent over time: same fingerprint, same proxy, same timezone.

Prepare for liquidity events

● CEX listings can move fast—pre-stage hedges and alerts on both CEX and DEX.

● Set conservative slippage and size limits; don’t chase volatile candles with oversized orders.

● Consider using time-weighted execution on DEX to reduce MEV impact and bad fills.

Build resilience

● Back up 2FA and store recovery codes securely.

● Keep a second operator with limited permissions ready to step in if your main device fails.

● Maintain a simple escalation plan: who contacts support, what to provide, and how to prove account ownership.

Practice strong security hygiene

● Verify domains and set anti-phishing codes on exchange accounts.

● Never sign unknown smart contract calls; read transaction prompts carefully.

● Rotate passwords periodically and use a reputable password manager.

Conclusion

In short, CEX launchpads deliver structure and scale, while DEX access offers sovereignty and composability. The most resilient approach blends both: one compliant, verified account (or corporate account with permitted sub-accounts) for Binance Launchpads, plus clearly segmented wallets for on-chain execution. Use AdsPower to isolate profiles, bind stable proxies, and keep clean logs so people, devices, and permissions never cross-contaminate. Rehearse timelines, document every step, and harden security with 2FA, hardware keys, allowlists, and anti-phishing codes. When you operate inside the rules—and design for auditability—you reduce risk, avoid costly mistakes, and give your team the best chance to capture high-quality allocations confidently and repeatably.

People Also Read

- How to Create Multiple Instagram Accounts Safely 2026

How to Create Multiple Instagram Accounts Safely 2026

Learn how to create multiple Instagram accounts safely, with or without a phone number, and manage them without triggering restrictions.

- Can You Have Multiple Telegram Accounts in 2026?

Can You Have Multiple Telegram Accounts in 2026?

Learn how to run multiple Telegram accounts in 2026, including official limits, phone number requirements and device setup.

- How Can I Have Multiple WhatsApp Accounts 2026?

How Can I Have Multiple WhatsApp Accounts 2026?

Learn how to manage multiple WhatsApp accounts in 2026 using dual SIM, WhatsApp Business, app cloning, or browser tools. Safe setup tips included.

- How to Register a Gmail Account Without a Phone Number 2026

How to Register a Gmail Account Without a Phone Number 2026

Learn how to register a Gmail account without a phone number in 2026. Follow our expert guide to bypass verification using clean IPs and AdsPower

- Badoo Ban – Why & How to Get My Badoo Account Unblocked

Badoo Ban – Why & How to Get My Badoo Account Unblocked

A complete guide to Badoo bans explaining why accounts get blocked, how to appeal and restore access, detect IP bans, and lower the risk of being bann